how are rsus taxed in california

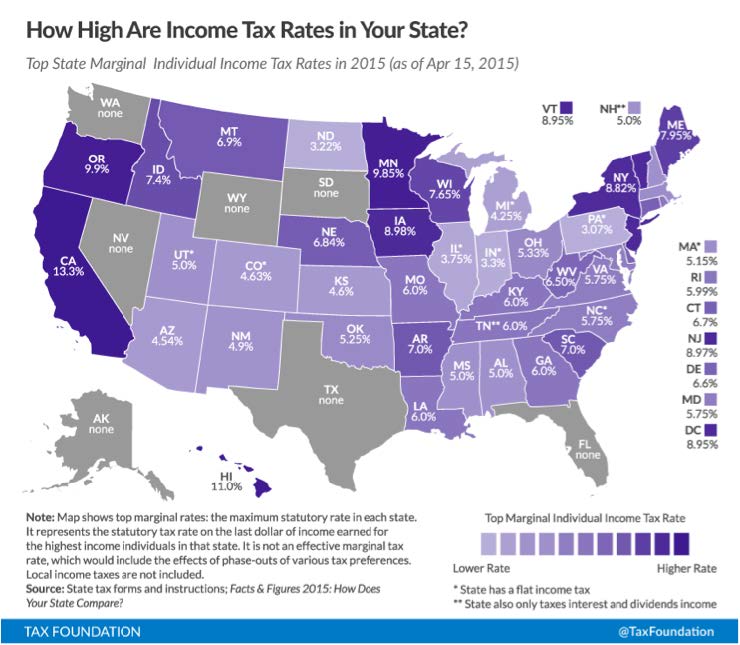

The RSUs all vested in 2012 two years after the taxpayer became a California nonresident after moving abroad. Theyre taxed as ordinary income - so its based on your marginal tax bracket.

Restricted Stock Units Jane Financial

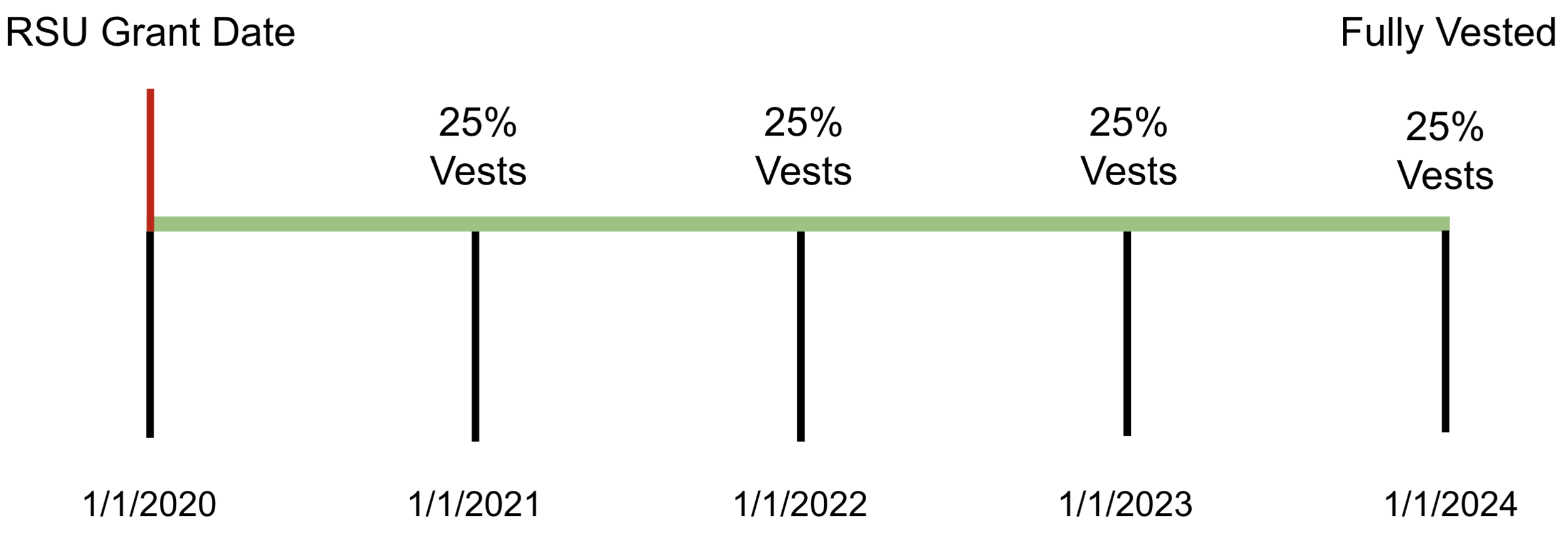

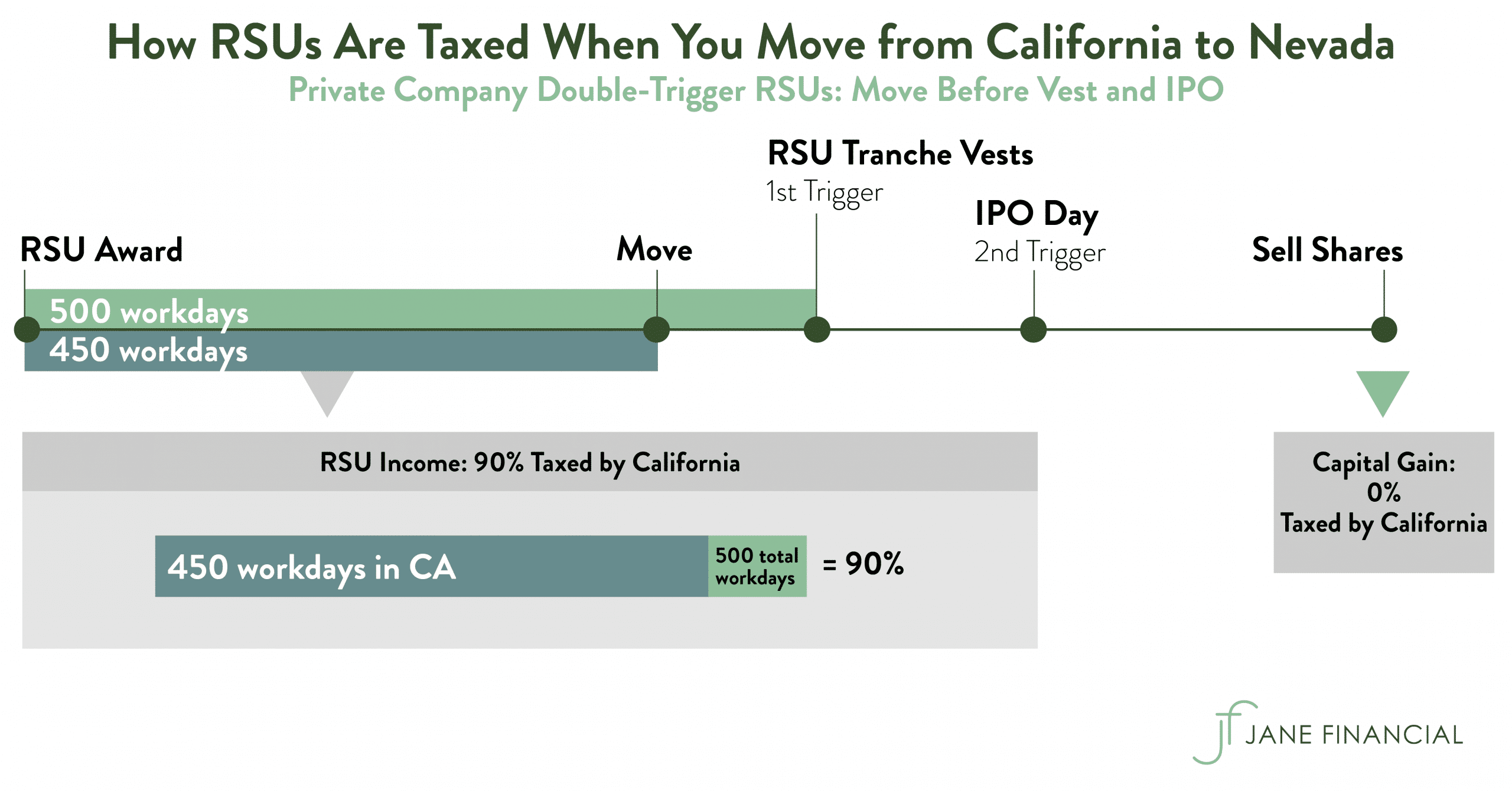

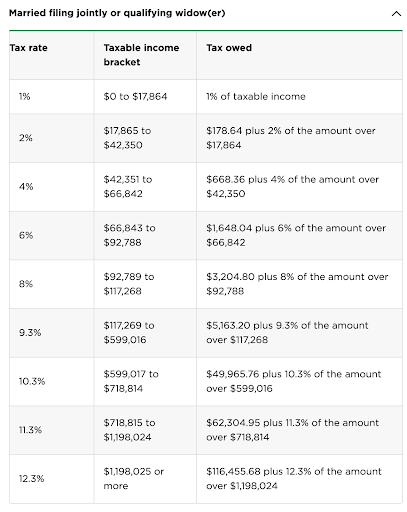

And keep in mind that when your shares vest in 2021 and 2022 a portion will still be taxable in California.

. The four taxes youll owe when you receive a paycheck or when an RSU vests include. You lived in California through June 30th and moved to Washington on July 1st. Many employees receive restricted stock units RSUs as a part of.

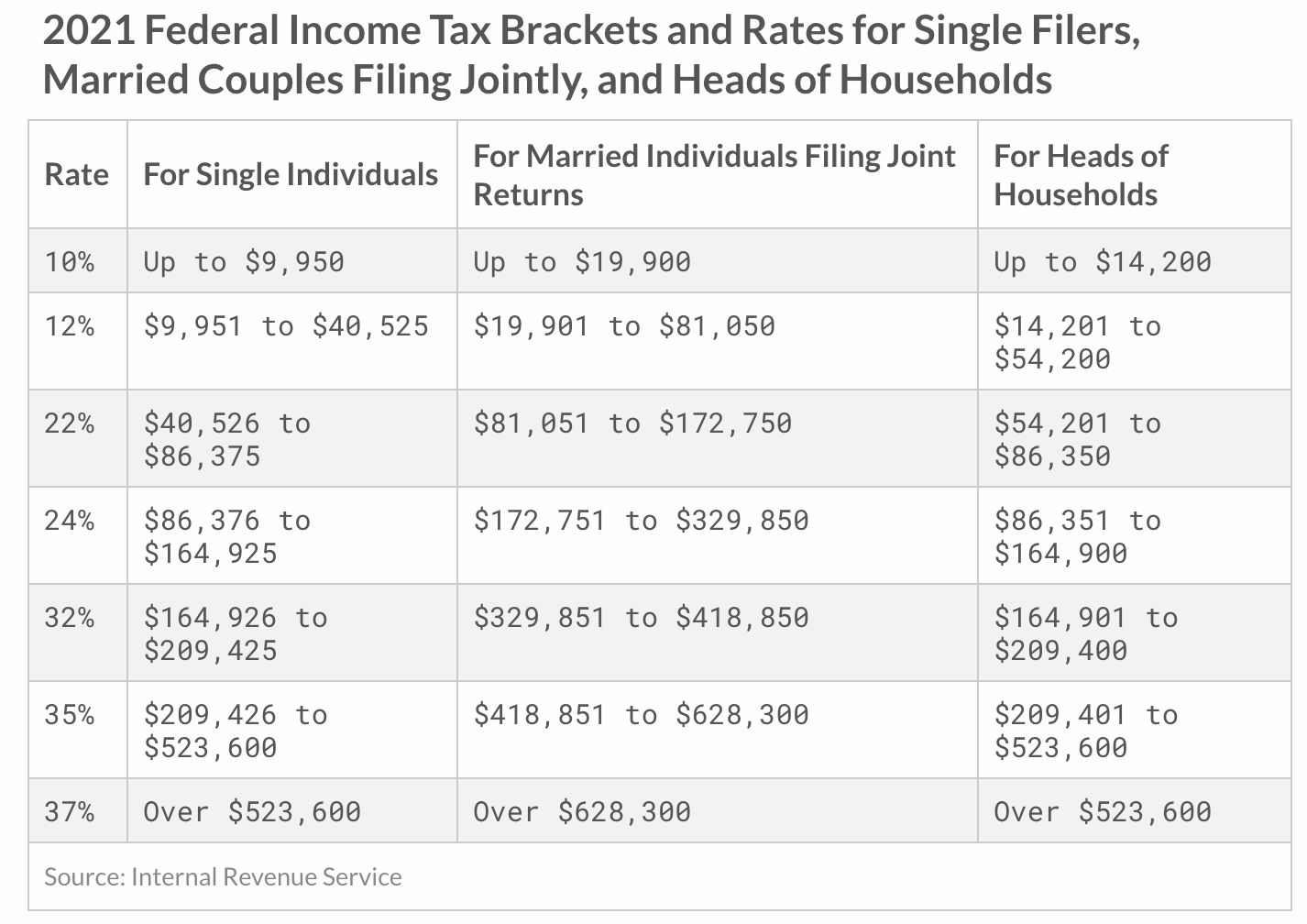

As your actual tax rate increases including FICA state taxes etc it becomes more expensive to vest into RSUs. Value of the unvested RSUs before taxes. The value of over 1 million will be taxed at 37.

Restricted stock units RSUs are becoming a more common type of compensation in California. For very high earners 360K for single filers and. RSUs are a form of compensation offered by a firm to an employee in the form of company shares.

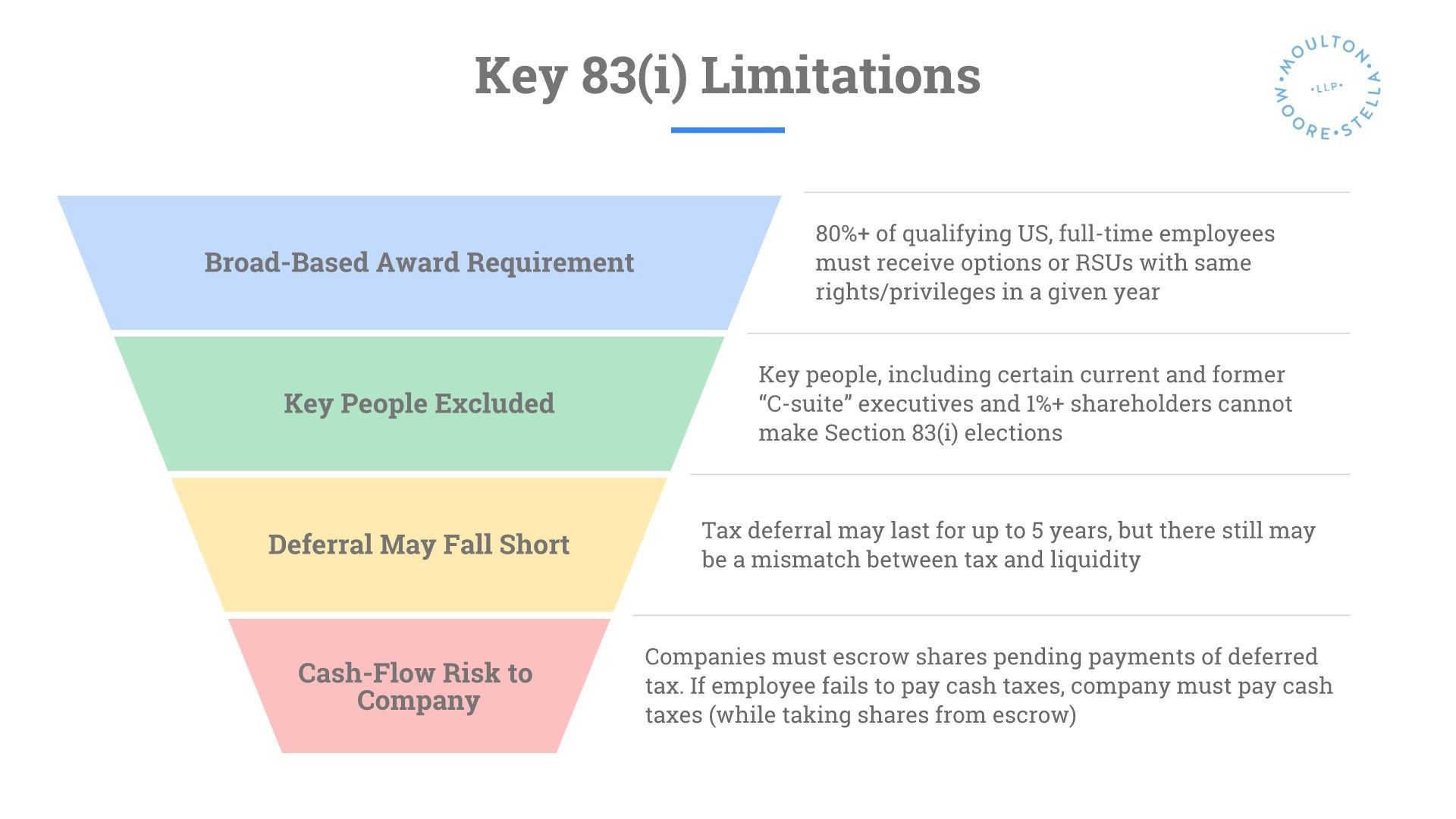

Ordinary Income Tax. Originally reporting the full value of the RSUs on his. RSUs are generally subject to a vesting schedule meaning the stock does not.

University of Southern California School of Law I have been practicing law exclusively in the. When your restricted stock units vest and you actually take ownership of the shares two dates that almost always. RSUs including so-called double.

If youre in the 25 bracket and get 10k of RSUs youd pay about 25 federal tax and 9 state tax 35k. On January 1st 2022 250 shares 14 of your RSUs will vest at a stock price of 10. Answer 1 of 2.

If you were a California state resident on the day that the RSUs were granted you pay California state taxes on the day that they vest based on the amount of time. RSU Taxes - A tech employees guide to tax on restricted stock units. For California income tax the mandatory withholding rate is 1023.

California taxes RSU income in two steps. RSUs in a Divorce. RSUs are taxed as ordinary income thus the rate that the recipient may pay can range from 10 to 37 depending on the recipients household income.

Your company is required to withhold a fixed 1023 tax for California income tax. Federal Income Tax - Varies based on income. In some states such as California the total tax.

Social Security Tax - 62 up to. In some cases you might pay taxes in California for years after leaving. Also restricted stock units are subject.

California taxes vested RSUs as income. In this guide we summarize how stock options are taxed in California covering the implications for ISOs NSOs and RSUs. RSUs are taxed at the ordinary income rate when issued.

When you exercise ISOs you may owe California. This doesnt include state income Social Security or Medicare tax withholding. For restricted stock units RSUs California has a formula for determining how much of the income from your RSUs is California income.

Carol Nachbaur April 29 2022. Taxes at RSU Vesting When You Take Ownership of Stock Grants. Instead of the employee receiving stock shares.

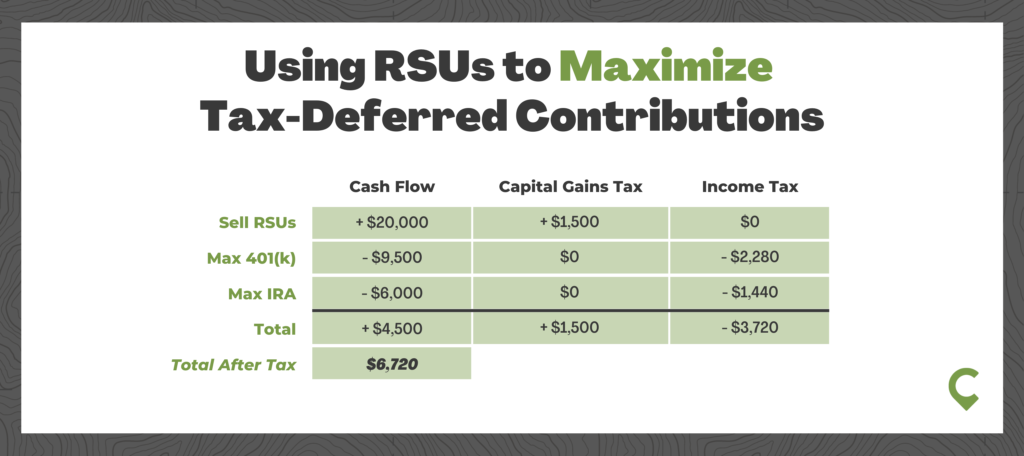

Restricted stock and RSUs are taxed differently than other kinds of stock options such as statutory or non-statutory employee stock purchase plans ESPPs. With an all-in tax rate of 15 you only need to pay.

Why Tax Reform S Special Incentive For Unicorns Failed

![]()

What The Heck Is An Rsu And What Do I Do With Mine And How Is It Different From A Bonus The Planning Center

Rsus Vs Options What S The Difference How To Switch Carta

Rsus Basics And Taxes San Francisco Ca Comprehensive Financial Planning

Common Rsu Misconceptions Brooklyn Fi

Restricted Stock Units In Nqdc Plans Executive Benefit Solutions

Rsu Vs Rsa What S The Difference District Capital Management

I Have Rsus But Didn T Sell Any Why Is My Tax Bill So Crazy Mana

Double Taxation Between Ca Ny Nj

I Have Rsus But Didn T Sell Any Why Is My Tax Bill So Crazy Mana

Restricted Stock Unit Rsu How It Works And Pros And Cons

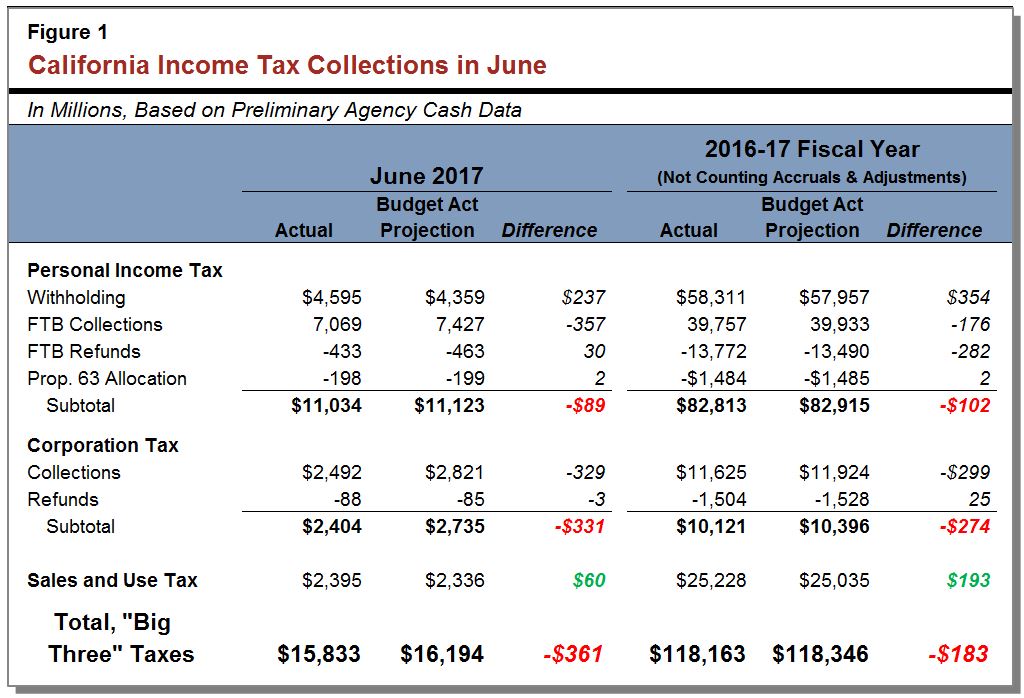

June 2017 State Tax Collections Econtax Blog

Reporting Sales Of Stock On Your Taxes H R Block

Rsu Taxes Explained 4 Tax Strategies For 2022

Pre Ipo Rsus Single Trigger Vs Double Trigger Grants San Francisco Ca Comprehensive Financial Planning